What to Expect as an EIT in the Dynamic Oil & Gas Industry

Starting out as an Engineer-in-Training (EIT) in the oil and gas industry is a wild ride. It is one of those sectors where you quickly learn that no two days

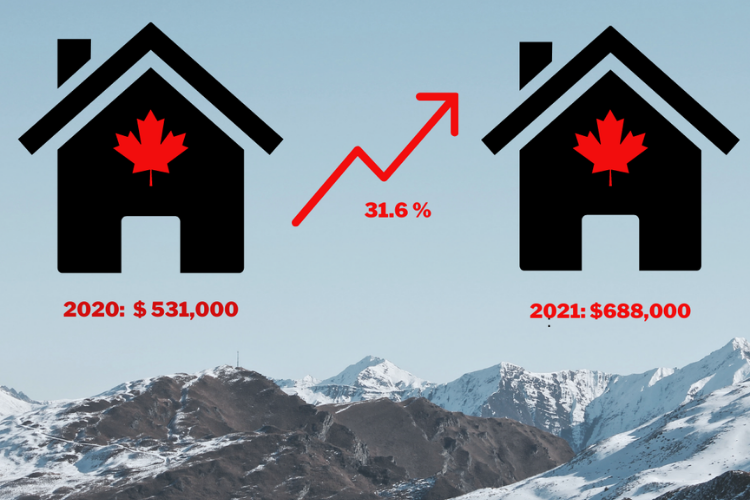

Real estate is vital to Canada’s economy, constituting almost 10% of our national GDP. However, young Canadians are being hit particularly hard by astronomical housing prices and a supply shortage in the real estate market. In March 2021, the price of Canadian houses had increased 31.6% from 2020. Canada’s housing market is expensive and unpredictable, which is becoming problematic for young people and new Canadians.

Of course, the current housing market has spawned a plethora of memes about millennials and the struggles of owning a home. While I love to see humour in a dark situation, it’s clear that we young Canadians have very valid concerns about the likelihood of us ever owning property.

This is a theme seen across the country. Folks in the Maritimes and BC alike are looking to capitalize on low interest rates and increased savings from the COVID-19 pandemic. There’s been a surge in people from Ontario moving to the Maritimes to leave behind their busy lives and high COVID case numbers, driving up the prices of homes in the Atlantic provinces.

There is also a surge in home prices in the greater Toronto area, likely attributed to Torontonians looking to pay lower interest on a bigger home. Experts are saying this isn’t new for Toronto; for years, aspiring homeowners have been leaving the city to find more space. However, the skyrocketing home prices is a recent development.

It is unlikely that the current trend will be reversed any time soon. Canada Mortgage and Housing Corporation predicts the craze will last at least another couple of years. And this is unlikely to slow down unless supply increases significantly, which might require government action or significant shifts in the Canadian economy. Until then, prices will surpass the rate of inflation, edging more Canadians out of homeownership.

Despite the increase in housing prices, homes are now selling faster than ever. In Calgary, the Calgary Real Estate Board (CREB) reported 2,989 homes sold in May and 3,209 were sold in April. In May, 4,562 homes were listed for sale in Calgary.

Calgary is also seeing a surge in the sale of luxury homes. Over one quarter of sales have been homes worth more than $600,000, indicating Calgarians are taking advantage of the current low interest rates.

Earlier in the pandemic, SFC’s own Hunter Turnbull was struggling to buy property in Calgary. At the beginning of his search, Hunter wasn’t even allowed to look at a home in person. Then, communication between realtors and the seller’s legal team lagged because face-to-face communication was prohibited.

However, Hunter was eventually able to overcome those barriers to capitalize on a low interest rate and lower stress test, meaning he qualified for higher-end properties. He was fortunate to buy at a time when “homes were undervalued so I was able to secure a property well below the 2019 tax assessed value.”

A year later, young Canadian buyers are running into a different set of challenges.

Calgary-based SFC member Kira is having a tough time finding a house in her budget, noting how “the market has been crazy lately and houses are selling only hours after hitting the market”. She’s finding it especially hard as a first-time home buyer to act on a house in time, especially when the buyer has a strict budget.

In Kira’s experience, Calgary homes are experiencing bidding wars that put prices through the roof. Buyers are paying much much more than asking price; thanks to quick changes in both the housing market and in Canada’s broader economy.

Nationally, the average price of a home was $687,091, which may be problematic for young Canadians who want to own a home. When 2000 Canadians over the age of 18 were surveyed by RBC, almost half of respondents indicated their budget is less than $500,000.

But CREB Chief Economist Ann-Marie Lurie predicts that supply will start to meet demand soon and the market will balance itself out again, noting that “it’s just taking some time.”.

However, the sudden increase in house prices is making life in major Canadian cities less affordable than ever. Vancouver, Toronto, Hamilton, and Ottawa are now considered less affordable than Seattle and New York City.

(Via CTV News)

So while some Canadians are able to break into the housing market thanks to diminished interest rates and COVID-related savings, others are worried that they may never own a home. This is a sentiment that 36% of Canadians under age 40 believe to be true, according to a recent survey by RBC. 62% of those studied also believe most Canadians will be priced out of the market completely over the next decade.

Canada lacks affordable housing, and it’s now becoming more clear that we lack housing, period. In 2016, there were 427 homes per 1,000 Canadians, but that has dropped to 424 houses per 1,000 in 2020. To maintain the 2016 ratio, Canada would have to build over 100,000 homes. Although this seems marginal, it is a concerning figure especially for young Canadians.

Our housing-to-population ratio is the lowest of any G7 nation. And it’s estimated that Canada would have to build 1.8 million new homes to match our fellow G7 states. So while millennials and generation Z are currently stressed about finding affordable housing, Canadian economists are predicting that this will soon be a nationwide trend.

Sign up for updates about our work at YCR. Please sign up using a personal email and not a work or school email if possible.

"*" indicates required fields

Starting out as an Engineer-in-Training (EIT) in the oil and gas industry is a wild ride. It is one of those sectors where you quickly learn that no two days

These are only a few things I’ve heard about the natural resource industry amongst my peers over the last couple years.

As I am here in Alberta for the summer I am going to explore the types of jobs open to me on an oil rig as an inexperienced worker.